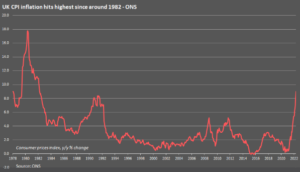

How inflation affects your wealth and what we can learn from the past

There’s no hiding from the headline news that the UK’s inflation rate remains on the rise.

Fuelled by the rising cost of gas and electricity, inflation reached a 40-year high of 9% in April 2022, a high that is still present as of October 2022.

When the latest rise was announced, the Office for National Statistics (ONS) said that the 54% increase in the energy price cap in April was the main reason for the hike in the Consumer Price Index (CPI), but it isn’t the only influencing factor.

Contributing factors to rising inflation

Russia’s invasion and war in Ukraine has contributed to spiralling fuel and energy prices throughout the west. This came at a time when the economy was only just beginning to return to normal following the Covid pandemic.

Supply chain issues, caused by both the pandemic and the war in Ukraine, have contributed to inflation. While demand remains high, and supply is low, this will lead to greater competition and rising prices.

Reuters reported that the Bank of England (BoE) have forecast that inflation will top 10% during 2022 and investors expect the central bank will add to the four interest rate increases it has implemented since December.

Source: Reuters

Read more: The 3-day week: What happens when inflation spirals out of control

Also contributing to an additional rise in inflation is the UK’s current political climate. Liz Truss’ economic plan, announced by Kwasi Kwarteng in September, unnerved the financial markets and undermined her political standing. The tension between this political climate and the monetary policies controlled by central banks isn’t out of the ordinary. Yet we are seeing policy manoeuvres to fight inflation that haven’t been seen in decades; the Bank of England, for example, has moved quickly to slow down escalating prices with an increase in interest rates which cut consumer and business spending short.

Inflation reduces the buying power of your money

The biggest problem with inflation is that it reduces the buying power of your money. This makes it more important than ever that your investment strategy is geared towards mitigating the effects of inflation as much as possible.

Fortunately, there are proactive steps you can take to help protect your wealth and investment portfolio during periods of high inflation.

Hold less cash

Since inflation erodes the real value of your money, holding too much cash will damage the buying power of the money you have in the bank. Even with the increasing interest rates, the return on traditional savings accounts cannot compete with inflation of 9%.

While it’s important to maintain ready cash in an easy-access savings account to act as your emergency fund, it’s wise to avoid holding excess money in the bank as it could be working to combat the effects of inflation better elsewhere.

Consider taking on more investment risk

The key to an effective investment strategy is to understand the subtle balance between risk and reward.

Generally, the more risk you’re willing to accept when you’re investing, the more chance you have of increased returns. Of course, the flip side is that by taking on more risk you increase the chances of fluctuation in the value of your holdings.

Most investment portfolios will hold a balance of equities and low-risk options, such as bonds.

Typically, the higher the proportion of equities you hold, the greater the potential investment growth.

In the short term, to give your investment holdings a better long-term chance of outperforming inflation, you may find it useful to increase equity exposure in your portfolio.

Select your sectors with care

Because some sectors perform better than others when inflation is high, it can be sensible to assess where your portfolio is weighted.

Sectors such as infrastructure and property tend to be more resilient to inflation than others.

Similarly, consumer goods suppliers have more flexibility built into their pricing, which can give them an advantage and help them to ride out rising inflation more easily.

Gold, commodities, property, and index-linked securities can all offer an element of portfolio protection in a more inflationary environment.

During periods like this, you may even want to consider expanding your property portfolio or starting to invest some of your wealth in buy-to-lets.

Although none of these options provides a perfect inflation hedge, they can be used to mitigate against inflation.

Make the most of dividends

Dividends paid out by many blue-chip stocks can also prove a useful hedge.

Dividend yields aren’t necessarily linked to the performance of company shares, even if their stock value falls. This means that they can provide a source of growth in your portfolio, especially if you make sure that any dividends paid are automatically reinvested to purchase new shares.

The beauty of this is that you’ll get the benefit of dividend compounding – effectively “growth-on-growth”.

Work out your personal inflation rate

Understanding what your personal inflation figure is and how you’re spending your money could highlight areas of spending where adjusting your outgoings may help reduce the effect of cost of living rises on your finances.

For example, if you do a lot of driving, the 12-month inflation rate for motor fuels is currently 31.4%. Costs of transport, restaurants, clothing, and hotels are also rising more sharply than other sectors.

If you like travelling and eating out, then your own personal inflation rate could be higher than the UK’s 9% rate.

Understanding your personal inflation rate, and what you spend your money on, will influence how susceptible you are to inflation – both now and in your retirement.

With sophisticated cashflow modelling software, we can create multiple financial forecasts using assumptions such as your personal inflation rate.

This can help you visualise whether you’ll have enough to enjoy the life you want in retirement, including drawing a higher sum every year to take the effects of your own personal inflation rate into account.

Take a long-term view

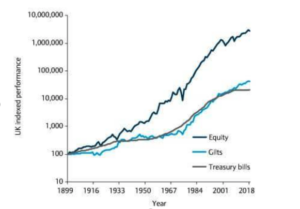

A study from Barclays found that £100 invested in cash in 1899 would be worth just over £20,000 in 2019.

Meanwhile, £100 invested in gilts would be worth close to £42,000.

However, £100 invested in equities in 1899 would now be worth around £2.7 million.

The chart below illustrates how equities, over the long-term, outperform cash and gilts.

Source: Barclays

While the data provides compelling evidence of equities’ outperformance over 118 years, most of us have far shorter investment horizons.

How we can help you make and save money

Our evidence based approach to investing means that we always aim to keep costs as low as possible for the investments that we recommend. This also means selecting fund managers who have a commitment to reducing costs and passing these savings on to clients.

We are always looking for ways to reduce the cost of investing for clients and, while everywhere else costs seem to be rising, we recently cut our investment fees.

Get in touch

If you’d like to talk to us about how inflation could affect your investments, and the steps you can take to mitigate the risks to your wealth, please get in touch. Email hello@firstwealth.co.uk, book a video call, or phone us on 020 7467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability