What Might Be Seen When Investing in 2024?

At least 2023 saw some sort of return to normality. The gilt market didn’t blow up, there wasn’t a general election, and the stock market didn’t crash. How expectations have shrunk. In 2024 we think it reasonable to expect unimpressive economic performance but, perhaps, better market performance.

Here’s what the patterns indicate about 2024 investing.

Economic anaemia

It’s been published regularly since 1843 – so The Economist newspaper tends to get things right.

And its predictions for 2024 include plenty of reasonable claims: more electric vehicles, more spending on healthcare, artificial intelligence having more bark than bite … and the global economy will grow at 2.2%[1].

2.2% is anaemic by anyone’s reckoning.

Global economic growth sits at 3.1% and, since 1960, has dipped meaningfully below 2% on just five occasions[2]. They’re all the obvious ones, from the oil crisis and stagflation of the mid 1970s to the recent tragedy of pandemic, now hopefully consigned to history.

But let’s remember 2.2% is the global average. If we focus the microscope onto our own islands for a moment, the economy’s red blood cells become even harder to find.

Experts at KPMG suggest UK growth of just 0.3% next year. Others tend to agree[3].

Markets, not the economy

Here’s the good news.

Economic performance and stock market performance are not the same thing. A stuttering economy can be home to a vibrant stock market. That includes investing in 2024.

It’s something we touched on in a recent blog, so we won’t repeat the points here. Suffice to say that an investment in the UK stock market exposes your money to global opportunities in a way the national economy can’t – something to consider when investing in 2024.

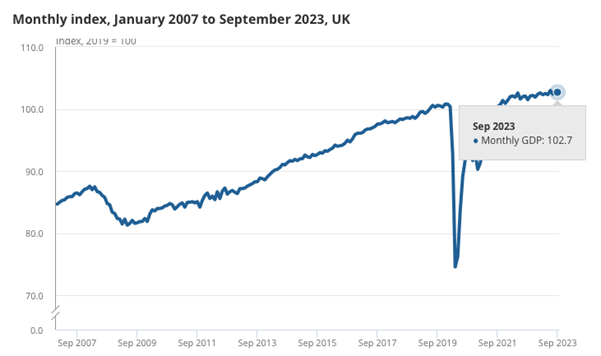

British GDP growth over the long run has been solid if unspectacular, as the chart below shows.

Source: https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/september2023

More ups than downs?

But stocks markets have done better.

When people think of stock markets, the FTSE100 springs to mind. That’s the 100 biggest companies listed in London: Lloyds Banking Group, BT Group, AstraZeneca, and all the rest.

But there’s another index you’ve probably heard of, the FTSE All Share, which has hundreds of listed companies on it and is – arguably – a better indication of the performance of British businesses.

Over the same period, it’s displayed the sort of volatility you’d expect from shares but, and here’s the thing, there are more ‘up’ days than ‘down’ ones.

Source: https://markets.ft.com/data/indices/tearsheet/charts?s=FTAL:FSI

The same can be said of most global stock markets. If you look at just about any index over a good period of time (say at least ten years) you can literally see long and determined rises, followed by short, sharp drops.

So, we don’t know exactly what will happen in markets next year (the fact is that no-one does). But we can say with confidence that it’s likely there will be far more days of positive growth than negative.

And what we also know is that the longer your money spends in the market, the more it can benefit from ‘up’ days.

A few things to look out for

In its 2024 predictions article, The Economist talks of buoyant emerging markets boosting equity returns.

This sounds reasonable. Academic evidence, using long-run analysis, tends to agree that emerging economies offer a kind of energy boost to a portfolio’s overall returns. Whenever possible we always diversify our clients’ portfolios towards such international opportunities – because it also provides valuable diversification.

It’s also sensible to expect smaller companies to do well versus larger companies. Recent research says they tend to outperform larger stocks by about 5% in periods of recession and recovery[4].

And last but of course not least, passive investing is likely to trump active investing. The former is where you hug the market through those ups and downs, the latter where you pay someone to do better than the market.

Active investing is fine in theory but less so in practice. It’s partly because it’s just so hard for one person or company to consistently beat the market over the long run. The other thing is the (high) fees they command erode your returns. There’s a vast swathe[5] of academic research showing just how much better passive investing is.

However 2024 turns out, whether the much-mooted general election disrupts things or not, we’ll be here by your side.

[1] https://www.economist.com/the-world-ahead/2023/11/13/ten-business-trends-for-2024-and-forecasts-for-15-industries

[2] https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2022&start=1961&view=chart

[3] https://kpmg.com/uk/en/home/insights/2018/09/uk-economic-outlook.html#:~:text=Economic%20Outlooks&text=The%20UK%20economy%20could%20struggle,are%20skewed%20to%20the%20downside, https://www.britishchambers.org.uk/news/2023/09/bcc-economic-forecast-fragile-economy-stuck-in-first-gear/ and https://www.niesr.ac.uk/publications/uk-heading-towards-five-years-lost-economic-growth?type=uk-economic-outlook

[4] https://www.schroders.com/en-us/us/individual/insights/do-small-caps-or-large-caps-perform-better-in-recessions/

[5] Such as https://scholarworks.wmich.edu/cgi/viewcontent.cgi?article=4632&context=honors_theses#:~:text=found%20that%20before%20fees%20the,investing%20consistently%20underperforms%20passive%20investing.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability