Fresh thinking might be the WD-40 you need to navigate the uncertain economic landscape

The world, and particularly the UK, has flipped upside-down in just a few short weeks. And what was once rusty, but turning, cogs have grinded to a halt. The economic landscape is changing, and it is changing quickly. So, staying stuck in your long-held views of what is and isn’t ‘good’ money management may no longer keep you afloat.

Instead, a fresh way of thinking may be the WD-40 your finances need to get unstuck and get the cogs spinning once more.

How (and why) has the economic landscape changed?

The mini-Budget announced by Liz Truss and Kwasi Kwarteng in September caused chaos in the markets, and central banks to increase their interest rates. But, even before the mini-budget, interest rates were rising in a bid to tackle inflation – which has been hovering at levels we haven’t seen since the early 1980s. Add this inflation to the fallout of the mini-budget, and we’re left with a situation where everything we thought we knew about the economic landscape has changed.

Beliefs about, and approaches to, money that many have relied on for the last fifteen – twenty years have all, as a result, been ripped up and thrown out. It would be foolish to think that you need not change your approach along with the markets; change is the best (and perhaps only) way we can get unstuck.

But what can you change, and how do you change it?

Mortgages and buy-to-let portfolios; what are the statistics?

Interest rates are going up. That is an undeniable fact.

The way for us to combat this is to adjust the way we think about borrowing money.

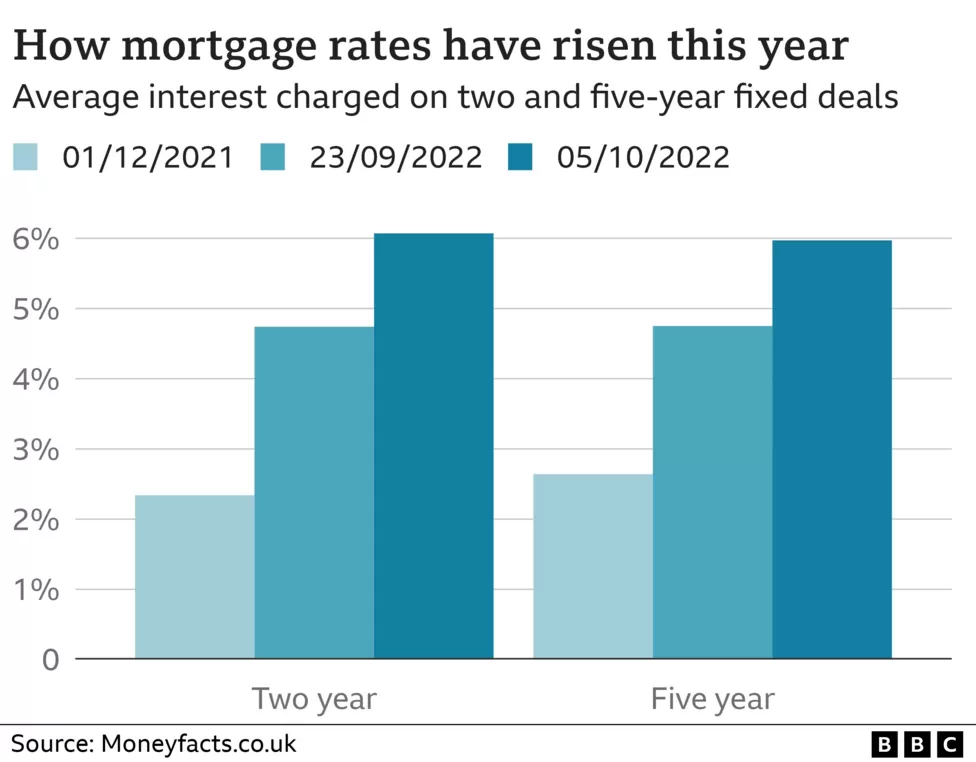

If we apply this to the specific borrowing context of mortgages, we see that the average interest rate on a two-year fixed-term mortgage has nearly tripled in the last year. According to Sky News, in 2021 you could get a deal of 2.25%, but that figure now sits at 6.3%.

Source: BBC News / Moneyfacts

Property investors, then, are perhaps the most in need of a WD-40.

Re-thinking property investment, mortgages, and buy-to-let portfolios

If you have a portfolio of buy-to-let properties, this could be the first time that you have faced a situation where it’s no longer cheap to borrow money. For some, new expensive mortgage deals won’t be covered by rental yields (unthinkable even a few weeks ago). When it’s time to renew your mortgage deals, you might find that interest rates outweigh the benefits of your current investment approach.

If you have multiple buy-to-lets, it may be worthwhile selling one or two properties and use the cash to pay down mortgages on the properties you keep.

This probably sounds scary; it’s the opposite of what most have believed for years. But clinging to the idea that you can’t sell and that property will always go up in value, is a rusted approach.

Selling one or two properties may, therefore, be the WD-40 your finances need to run smoother, cleaner, and better.

Re-thinking annuities

Another area that is suddenly back on the table and up for discussion is annuities.

When you buy an annuity, you essentially hand over a lump sum to an insurer in return for a guaranteed annual income. You may also choose other benefits, such as index-linking your income or providing a spouse’s pension when you pass away.

For a long time, annuities have been viewed as poor value. This perspective of annuities was solidified when, in 2015, the government announced Pension Freedoms (a scheme which aimed to give people more options as to how they took income from their pension savings). However, figures released in October 2022 showed that annuity rates have leapt by 44% in the last 12 months and are back at levels we haven’t seen since early 2009.

To put it simply, annuity income amounts are on the increase.

But what does this mean?

For instance, the Guardian reports that a 65-year-old retiree with a pension pot worth £100,000 could get an annuity income of £7,191 a year. This is a really significant increase; in October 2021 the same pension pot would have only provided a guaranteed income of £4,989.

As a result, the main advantage of annuities is now more attractive than ever; a regular guaranteed retirement income for life, or for a fixed term, may provide certainty in this uncertain economic landscape. It’s also important to remember that annuity purchase doesn’t need to be a binary decision. Many people choose a combination of drawdown income and annuity income to fund retirement. If you can cover your basic expenditure via annuity and State Pension, you know that you will be ok, whatever happens. A great position to be in.

Stripping back your age old perspective of pensions and investing in annuities, therefore, may be the WD-40 you need to maximise the returns you get from your pensions and ensure a smooth(er) ride through these turbulent times.

Re-thinking the portfolio weighting to Government bonds

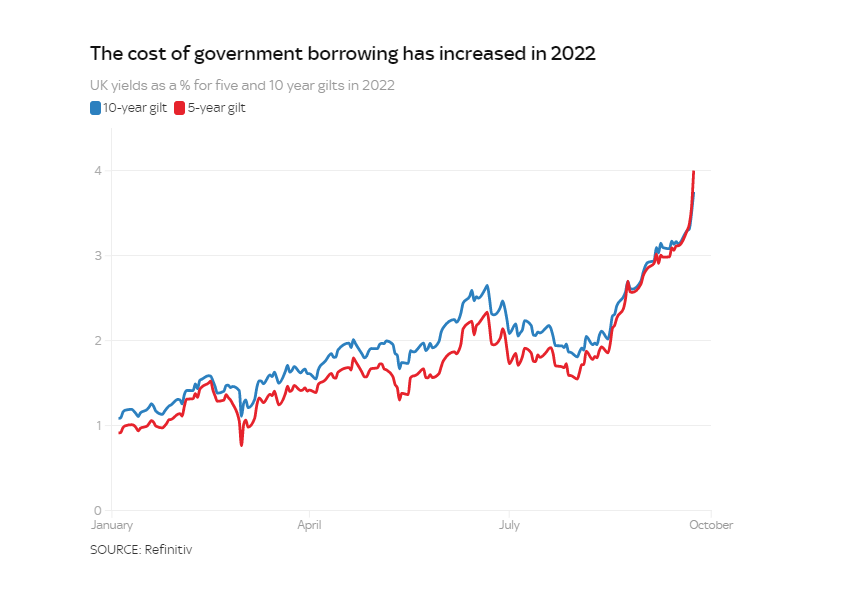

The most dramatic reaction to the initial mini-budget was seen in the bond market; faced with the prospect of a big surge in government borrowing, yields on gilts (UK government bonds) spiked as bond prices dropped.

Immediately following the mini-budget, Sky News reported that:

“The yield (an implied borrowing cost for the government) o

n 10-year gilts, which was 3.495% at the close of business on Thursday evening surged to as much as 3.842% at one stage – a level not seen since April 2011.”

Source: Refinitiv

Investing in bonds has always provided an element of security as a hedge against equity prices, but surging inflation will apply more pressure to central banks to tighten the monetary budget and more bond prices will continue to come under pressure. Indeed, the UK isn’t the only country to have seen an increase in its bond yields in recent weeks. The yield on both US Treasury bonds and German government bonds have also risen to multi-year highs in recent weeks.

Although investing in the stock market usually carries some additional volatility, allocating a higher percentage of your portfolio to equities is the best option to beat the long-term effects of rising prices. Ultimately, equity investing is the best way to get your finances unstuck from the prospect of falling living standards in the future.

Changing your views on financial planners

Many have been apprehensive about the prospect of consulting a financial planner for too long, and that has caused too many to become stuck in their uninformed ways. Some may think that planners see everything through the lens of financial returns, or that they can handle money just fine on their own.

But in truth, a good financial planner can:

- Remind you of the ‘big picture’: there are more important things than financial returns. A good financial planner will refocus you, and help you use your money to better your life.

- Save you time by doing the bulk of the ‘hard stuff’, reducing your anxiety and stress, and giving you peace of mind. This leaves you with more time to do the things you love; your wellbeing is a good investment in and off itself.

- Ask you the important questions that often go unnoticed when trying to ‘DIY’ your plan. For instance, does your strategy make sense? What does success mean to you? Is there another, better, way to achieve your goal?

Our clients have already taken this step, but there are so many others out there ignoring the power of a good financial planner.

This is why we are here. First Wealth acts as an impartial sounding board with a clear focus on helping you attain your business and personal goals. We will also help you make the big decisions and ensure you execute them in line with a financially beneficial long-term strategy.

Good financial planning is the best option to treat your thinking with WD-40 to navigate the economic landscape.

Get in touch

We’re here to help you look after your wealth and reach your life goals. If the changing financial landscape is causing you concern or you’re rethinking what is right for you and would like to chat things through, please get in touch.

Email hello@firstwealth.co.uk, book a video call, or phone us on 0207 467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability